Rhumb’s Focus: The Future Economy Metals

Rhumb’s exploration efforts to date have been dedicated to uncovering ground anomalies rich in metals that are crucial for the “Future Economy” or the “Green Economy.”

Platinum

It is an extremely rare silverish-white, dense, lustrous, ductile, and malleable, silver-white metal, highly unreactive and resistant to corrosion.

Platinum is used in catalytic converters, laboratory equipment, electrical contacts and electrodes, platinum resistance thermometers, dentistry equipment, medical treatments and jewellery. Platinum is used in the glass industry and will be essential as a catalyst the world moves towards a hydrogen-based energy economy.

Palladium

Palladium is an extremely rare lustrous silvery-white metal resembling platinum that is the least dense and has the lowest melting point of the platinum group metals. It is soft and ductile when annealed and is greatly increased in strength and hardness when cold-worked.

The largest use of palladium today is in catalytic converters. Palladium is also used in jewellery, dentistry, watch making, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contacts.

Osmium

Osmium is a hard, brittle blue-white tint that is the densest stable element; approximately twice as dense as lead. Osmium is the least abundant stable element in Earth’s crust.

Because of the volatility and extreme toxicity of its oxide, osmium is rarely used in its pure state, but is alloyed with other metals for high-wear applications. Osmium alloys are very hard and are used instrument pivots, and electrical contacts.

Cobalt

Cobalt is a hard bluish grey metal, normally found only in chemically combined form and recovered as a by-product of copper and nickel mining.

Cobalt was used for jewellery, inks and paints and to colour glass. It is now is primarily used in lithium-ion batteries, and in the manufacture of magnetic, wear-resistant and high-strength alloys. Cobalt occurs naturally as only one stable isotope, cobalt-59. Cobalt-60 is a commercially important radioisotope, used as a radioactive tracer and for the production of high-energy gamma rays.

Copper

It is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. A freshly exposed surface of pure copper has a pinkish-orange colour.

Copper is used as a conductor of heat and electricity, as a building material, and as a constituent of various metal alloys. The major applications of copper are electrical wire (60%), roofing and plumbing (20%), and industrial machinery (15%). Copper is used mostly as a pure metal, but when greater hardness is required, it is put into such alloys as brass and bronze (5% of total use).

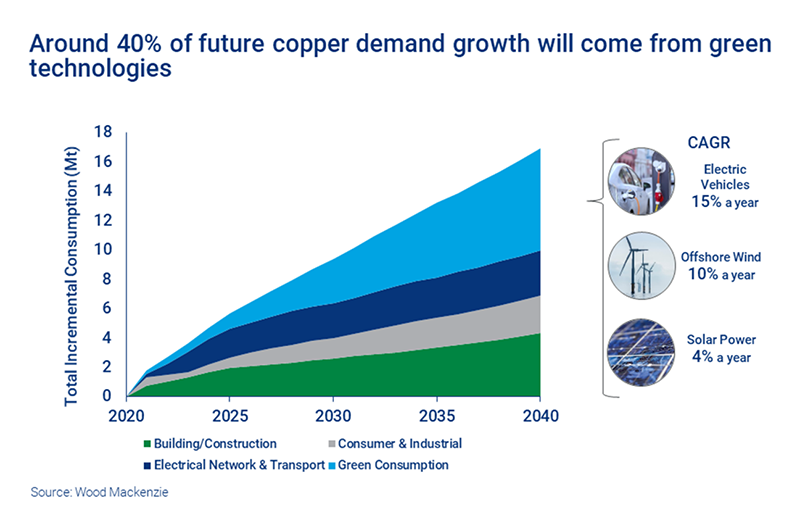

Copper usage averages up to five times more in renewable energy systems than in traditional power generation, such as fossil fuel and nuclear power plants.

Rare Earths

The rare-earth elements (REE are a set of 17 nearly indistinguishable lustrous silvery-white soft heavy metals.

Though rare-earth elements are technically relatively plentiful they are spread thin across trace impurities, so to obtain rare earths at usable purity requires processing enormous amounts of raw ore at great expense, thus the name “rare” earths.

Compounds containing rare earths have diverse applications in electrical and electronic components, lasers, glass, magnetic materials, and industrial processes. Globally, most REEs are used for catalysts, magnets, alloys, fuel cells and nickel-metal hydride batteries, glasses, and electronics. Additional uses for rare-earth elements are as tracers in medical applications, fertilizers, and in water treatment. [28]

Why a focus on PGEs?

Soaring demand

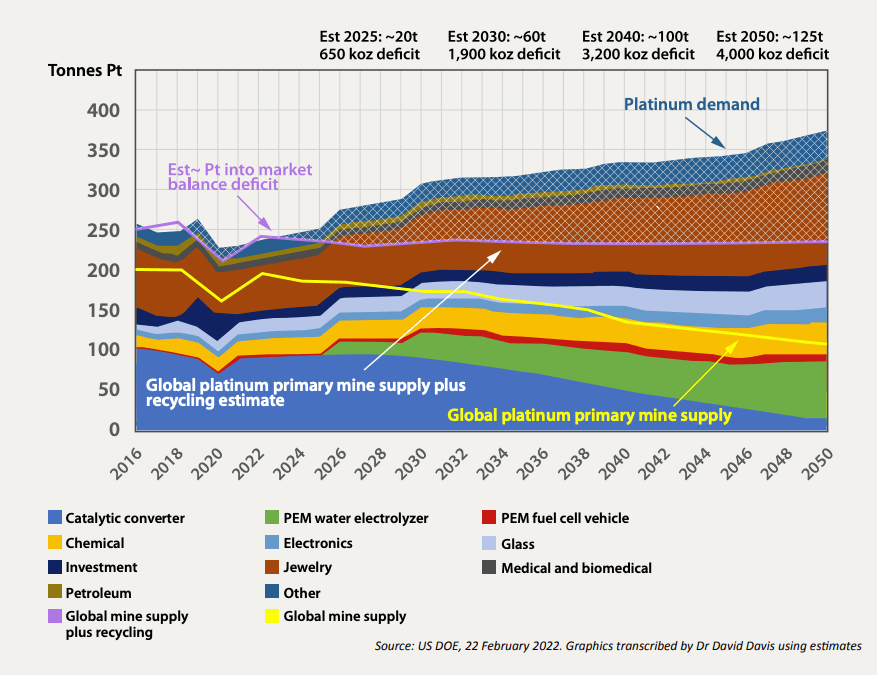

Principal drivers of recent increased demand for PGEs are:

- Stricter emission control systems on all ICE vehicles which require PGEs.

- The move to electric and hybrid vehicles which require extensive use of PGEs.

- Development of hydrogen fuel cell technology as a cheap pollution free, green energy. alternative to powering the electricity grids worldwide requires the substantial use of PGEs.

Limited supply

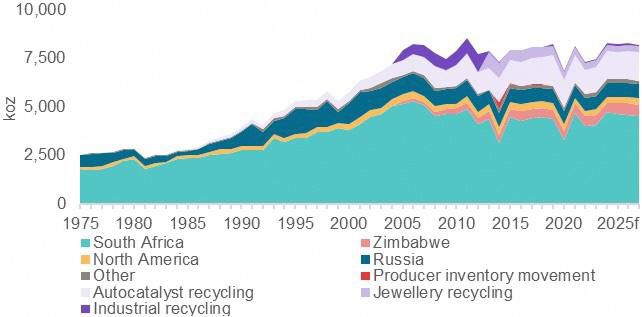

- The World Platinum Investment Council said in its fourth-quarter report that there was a change from a surplus of 776,000 tonnes (t) in 2022 to the forecast deficit of 556,000t in 2023. This reflects total supply remaining close to the weak level in 2022, up only 3%, and strong demand growth of 24%.

- Most of the world supply of PGE currently comes from South Africa (Bushveld) and Russia (Norilsk) and China (Jinchuan). World’s annual production in 2020 was 69,000T. Norilsk produced 691,000 troy oz worth $US1,117M.

- Norilsk supplies 50% of the world’s palladium with numerous other smaller deposits producing PGE as standalone or as a by-product from existing nickel and copper production; 2,809 troy oz in 2020 – at today’s prices worth > $US28.1M

- Existing PGE deposits are characteristically very deep; >1.5km deep and narrow chromite sills rich in PGEs. The development takes significant capital investment and up to 10 years for ROI.

- The recent discovery of the Gonneville Intrusion by Chalice Mining (ASX:CHN) at Julimar, 70km NNW of Perth and Galileo (ASX: GAL) near Norseman, as well as increasing commodity prices, has spurred a renewal in Australian platinum exploration.

Copper – Nickel – Cobalt; the Battery Metals

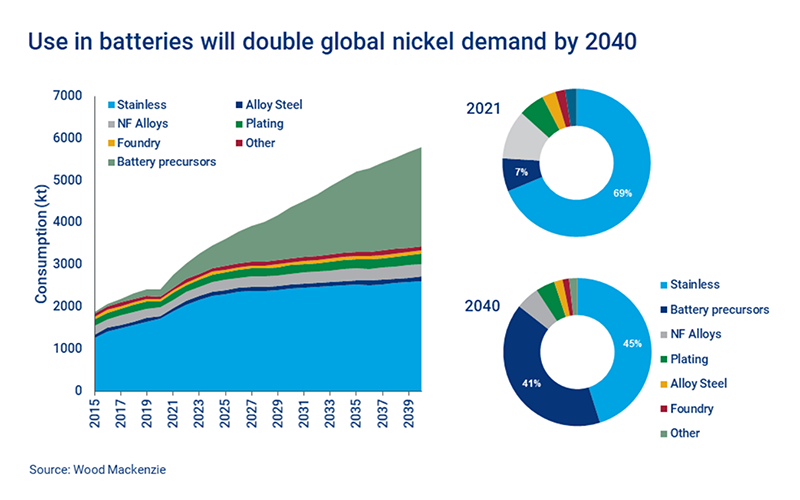

The transition away from carbon is driving a surge in the demand for the battery metals; in particular nickel, copper and cobalt.

Soaring Demand

- Steady growth in demand for existing uses but growth of the EV market and energy storage will underpin a huge increase in demand.

- Use of nickel for batteries will grow from 7% of total consumption now to 40% by 2040 – total demand likely to double.

- Demand for carbon will be driven by electrical applications; EVs, wind and solar. Move to green energy will require additional distribution best supplied by copper due to is lower carbon intensity to produced compared to aluminium.

Short supply

- No new nickel projects in Europe where recycling is being promoted to satisfy <20% of local demand.

- Most new developments in Indonesia with major ESG concerns around clean energy applications, air and water pollution and deforestation.

- Estimates need for additional 1.65 tonnes of nickel production needs to be brought on by 2023.

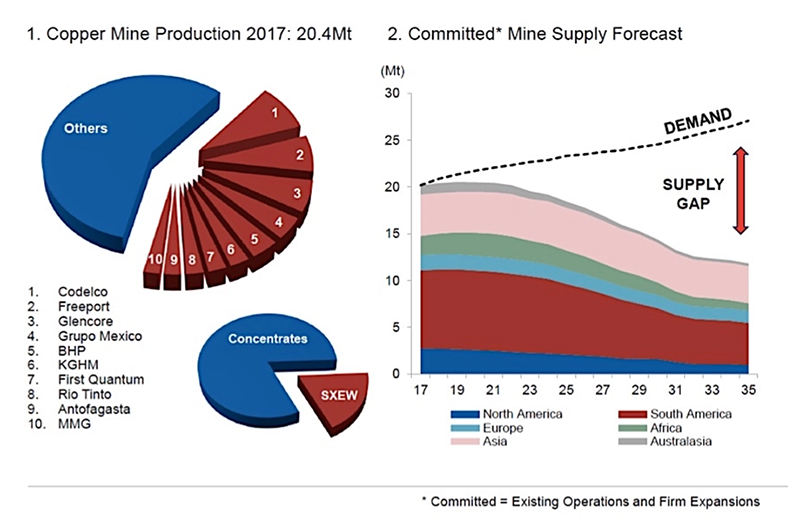

- Pool of advanced mining project for copper has not been so small since the early 2000s

- Increased recovery of scrap / recycling of copper will only go part way to satisfy demand

- Potential for 10-year supply gap of 5 million tonnes to 2031 and 15 million tinnes by 2035